Have you been a little nervous about jumping into the Houston real estate market? Buying a home now is certainly different than it was during the pandemic. But just because the market has shifted doesn’t mean that now isn’t a good time to buy a home. If you’re not sure whether a home purchase is the right move for you, then consider these reasons why buying now actually makes sense.

There are more homes to choose from

One thing that characterized the housing market over the last two years was a lack of inventory. Many serious homebuyers were unable to purchase a home simply because demand was so high but supply was so low. With the recent rise in mortgage rates, fewer people are in the market for a house. In addition, homes are staying on the market longer. That means there are more homes on the market today to choose from and you’re more likely to have your offer accepted.

Home prices are forecasted to stay steady

Are you worried that housing prices will crash after you’ve already purchased your home? Fortunately, this isn’t 2008 and most experts agree that Houston home prices will remain steady or continue to rise. Houston’s economy is performing pretty well, which should keep people feeling good about their ability to buy and keep people migrating to Houston.

Housing increases in value over time

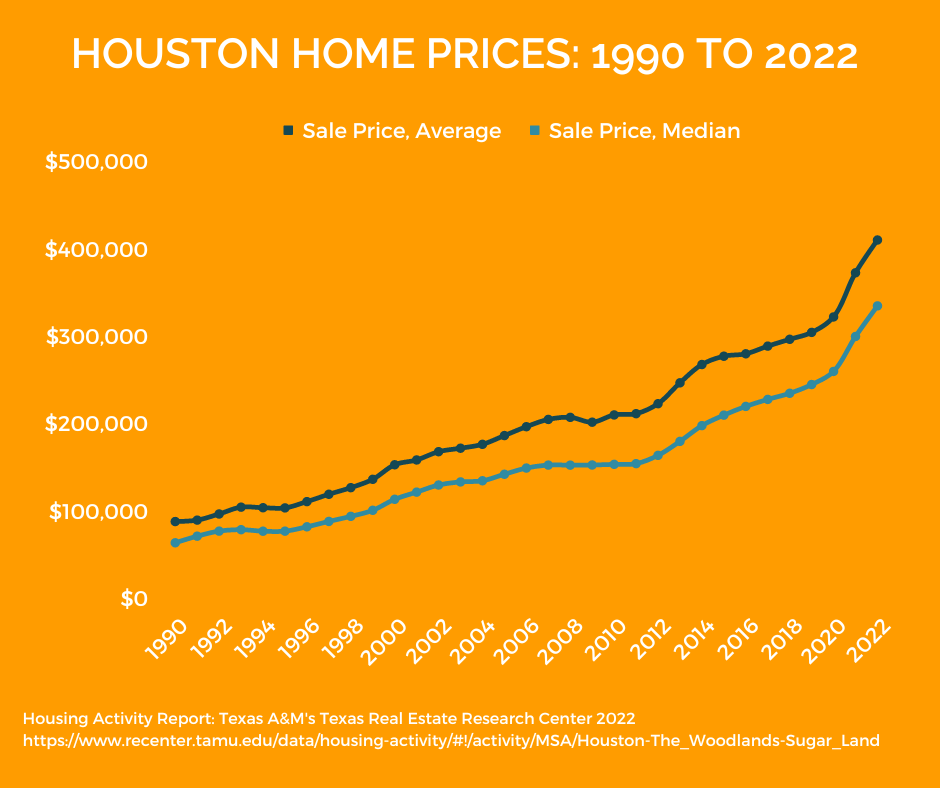

As the old saying goes, they ain’t making any more of it. Real estate continues to be the favorite investment of Americans because it historically increases over time. Overall, you should feel pretty confident that your Houston home will retain its value, and more than likely, increase in value in the coming years. According to Texas A&M’s Texas Real Estate Research Center, home prices in Houston have only declined year-over-year 3 times since 1990.

Mortgage rates should moderate

Many potential homebuyers have been scared away from the market in recent months because of skyrocketing interest rates. However, rates have steadied over the past several weeks as inflation eases. Inflation does have a big impact on mortgage rates, so if inflation continues to decline, then you can bet that rates will come down, too. For those that are in the market for a mortgage, it pays to shop around. Different lenders offer different rates, so be sure to check out all of your options before deciding.

Refinancing is always an option

On the flip side, if inflation doesn’t ease in 2023 and mortgage rates stay high, then remember that you always have the option to refinance at a later date. Mortgage rates fluctuate over time and you’re not locked into your rate forever. This works best if you’re planning to stay in your home for more than five years as there are closing costs associated with refinancing your loan.

You’re building your net worth

Are you tired of throwing your money away on rent? Then it’s always a good time to buy a home. When you purchase a home, the payments you make are helping you to build your net worth instead of your landlord’s. Every payment you make helps you build equity, which is the difference between what you owe on your loan and the value of your home. Equity is a powerful financial tool that you can leverage to purchase a second home, make renovations on your current home, or even finance an education.

If you are thinking about buying but are still unsure if now is the right time for you, let us know. We are happy to sit down with you to see if your personal circumstances and the state of the market in your preferred neighborhood make this a good time for you or not. Fill out the form below to get matched with a Norhill Realtor today.

[vr_column size=”1/2″ center=”yes”]

[vr_note note_color=”#FFFF66″]

GET MATCHED WITH AN AGENT

Oops! We could not locate your form.

[/vr_note]

[/vr_column]