Houston’s housing market demonstrated resilience through a rare winter storm in January, maintaining growth and balance despite temporary challenges. In recent weeks, mortgage rates have finally started to come down to late 2024 levels, which presents opportunities for buyers later this year.

Key Highlights from the Houston Association of Realtors (HAR) January 2025 Market Update:

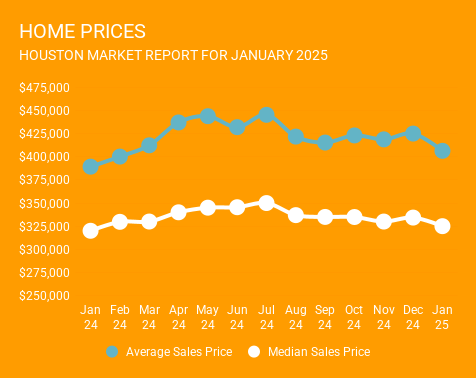

Home Prices: The average home price increased by 4.4% to $406,492, and the median price edged up by 1.6% to $325,000.

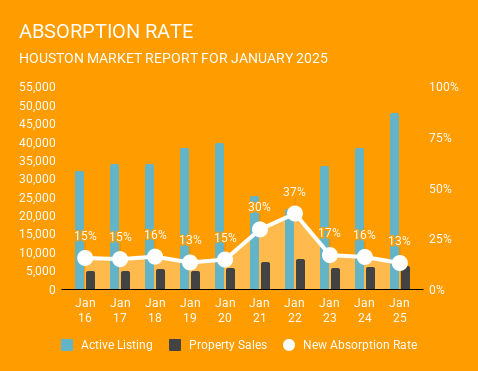

Likely to Sale: According to HAR, total active listings, or the total number of available properties, increased 26.3 percent to 47,864. January sales of all property types totaled 6,173 up 1.3 percent compared to January 2023.

As a result, the absorption rate, which is a measure of any given home’s likelihood to sell, for January 2024 was 13 percent. This is down slightly from the absorption levels we saw in 2024. However, this may have a bit to do with snow day week, which saw a relatively steep temporary decline in pending sales, which boosted January inventory.

Sales Overview: Single-family home sales in the Greater Houston area saw a 1.2% increase year-over-year, with 5,064 units sold compared to 5,002 in January 2024.

Market Segments: The luxury market ($1 million+) led with a significant 20.7% increase in sales. The mid-range market ($500,000 to $999,999) also saw substantial growth, with an 8.1% increase. However, the lower-priced segments experienced declines, with homes under $150,000 seeing the largest drops.

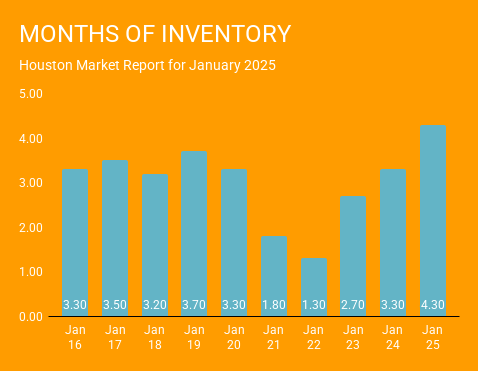

Inventory: Inventory levels expanded, with months of supply growing from 3.2 to 4.3 months, indicating a more balanced market. Housing inventory nationally stands at a 3.3-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-months supply is generally considered a “balanced market” in which neither buyer nor seller has an advantage.

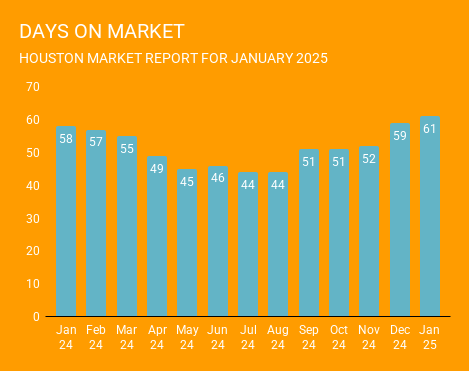

Days on Market:

At 61 days, the days on market has remained pretty stable over the past 2 months.

January Monthly Market Insights:

Despite the snowstorm, the housing market quickly rebounded, driven by ongoing demand and increased inventory. Sales remained robust across most segments, particularly in the luxury and upper mid-range categories.

Single-Family Homes Update:

January’s sales performance reaffirmed the market’s strength, with total property sales rising by 1.3% year-over-year. The average price per square foot increased, reflecting continued buyer interest and market value appreciation.

Townhouse/Condominium Trends:

Townhome and condominium sales saw a positive turn, increasing by 6.8% to 360 units sold. Despite a stable average price, the median price saw a slight decline, suggesting a varied response across different price points in this sector.

Looking Ahead:

With steady sales growth and a balanced inventory, Houston’s housing market is well-positioned for sustained activity. The continued interest in luxury properties and the stability in mid-range segments are expected to drive the market forward as we move into the traditionally busier spring months.

To receive more market updates like this one on a monthly basis, fill out the form below.

[vr_column size=”1/2″ center=”yes”]

[vr_note note_color=”#FFFF66″]

SIGN UP FOR OUR MONTHLY NEWSLETTER

Oops! We could not locate your form.

[/vr_note]

[/vr_column]