Despite rising mortgage rates, the Houston real estate market showed remarkable resilience in May. Homes continue to sell very quickly and home prices continue to rise. Thanks to a rise in new listings, homebuyers are finding more options as inventory levels hit a high for 2022.

According to the latest report from the Houston Association of Realtors (HAR), 9,627 single-family homes sold in May compared to 9,714 a year earlier for a .09 percent decline. This marks the 2nd consecutive month of year-over-year decline in single family home sales. On a year-to-date basis, however, the market is running 4.4 percent ahead of 2021’s record-setting volume.

The $500,000 to $1 million housing segment was the biggest performer last month with a 38.3 percent year-over-year sales increase in single family home sales. That was followed by the luxury segment (homes priced at $1 million and above), which jumped 30.2 percent.

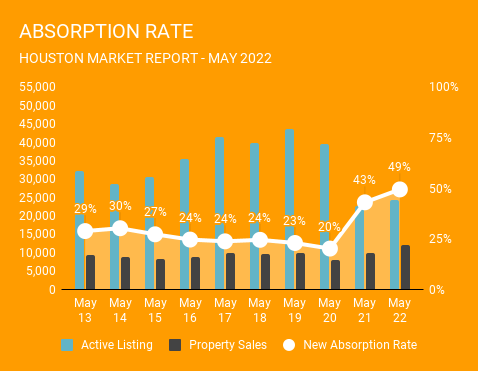

According to HAR, total active listings, or the total number of available properties, rose 14.9 percent to 24,301. May sales of all property types totaled 11,980, down 1% compared to May of last year. As a result, the absorption rate for May 2021 was 49%. That means almost half of all homes listed went under contract in May. That’s still higher than any May over the past 10 years.

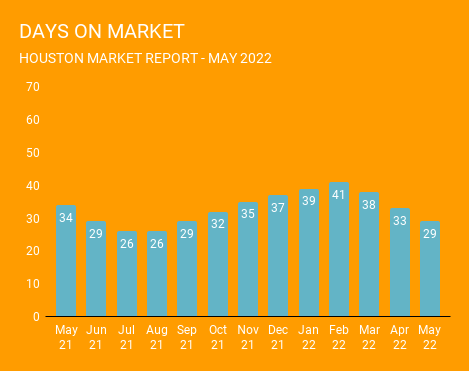

Homes moved a little faster in May. Days on Market (DOM), or the number of days it took the average home to sell fell to 19 days in May. Single-family homes inventory rose to 1.6 months. Housing inventory nationally stands at a 2.2-months supply, according to the latest report from the National Association of Realtors (NAR).

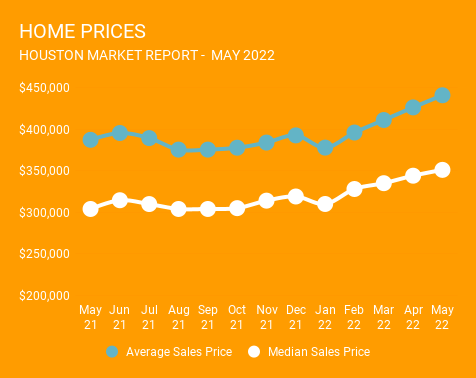

Over the next few months, we expect home sales to slightly moderate. However, even as mortgage rates increase, we do expect that inventory levels will continue to be relatively low. A 6.0-months supply is traditionally considered a “balanced market” (or not a buyer’s market, nor a seller’s market). We have a long way to go to hit that point. Although the rate of price growth might start to decline, we do expect home prices to increase in real numbers over the coming months.

Be prepared. Make sure you have all of the information you need to make an informed decision on when to start house hunting and buying. Contacting a Norhill Realtor is a good place to start. One of our experienced agents can talk you through the current state of the market in the neighborhoods you care about and get you connected with an experienced, professional mortgage broker so you can decide on the timing that works for you.

[vr_note note_color=”#f4f4f4″]Norhill Realty provides expert real estate services to residential buyers and sellers in Houston and surrounding communities. Contact us today for more information on Houston real estate and for professional assistance navigating this sometimes complex home market.[/vr_note]